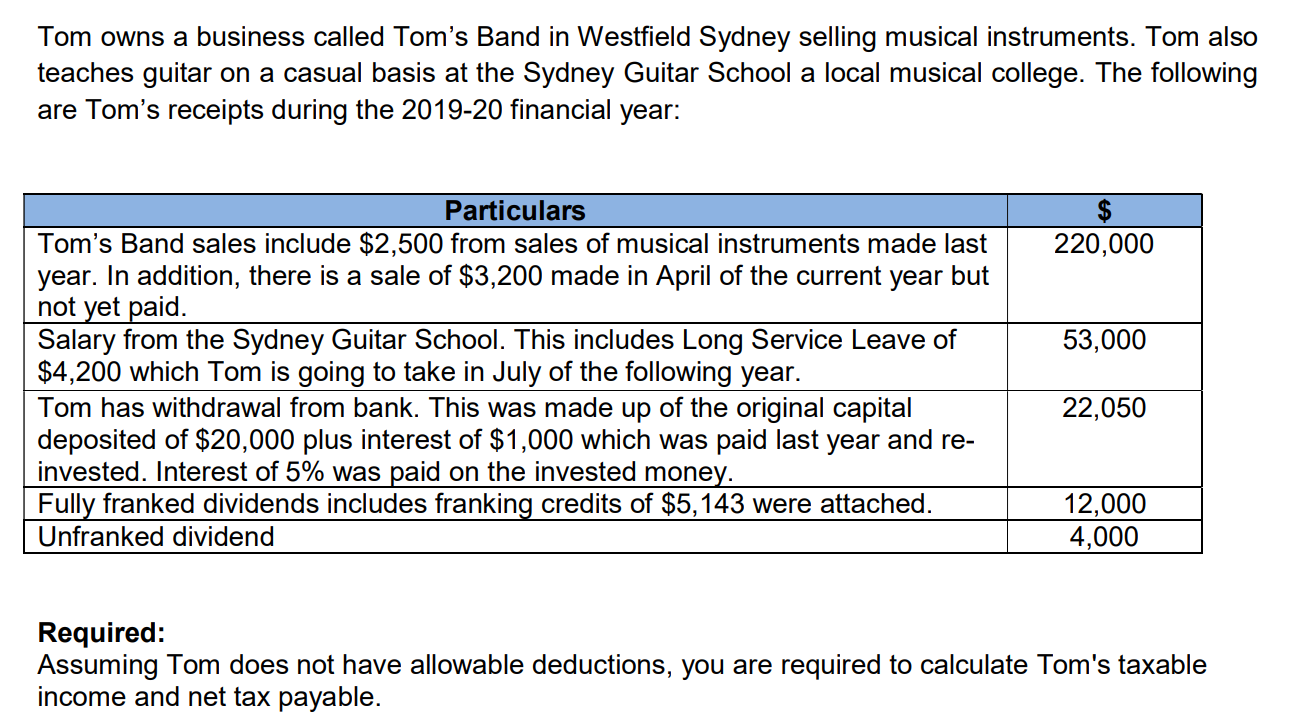

Sydney Income Tax Calculator

Simple calculator for australian income tax.

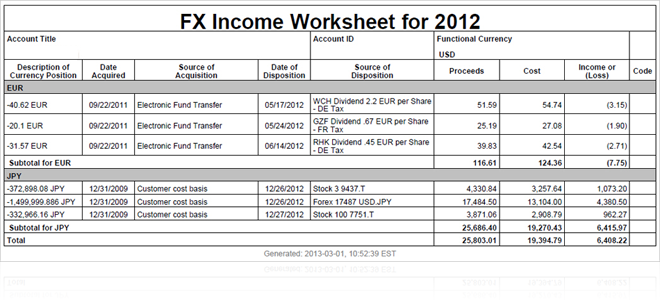

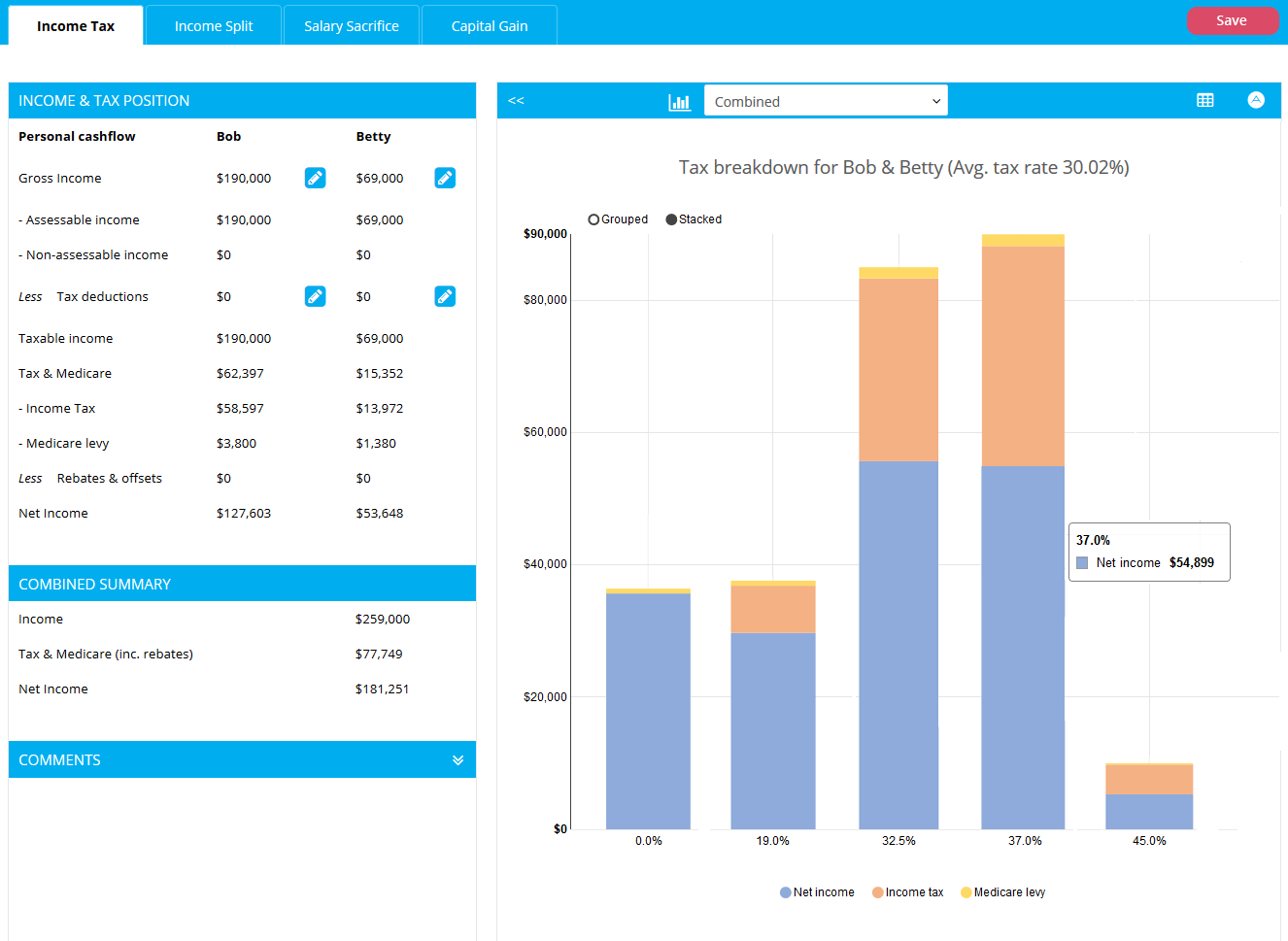

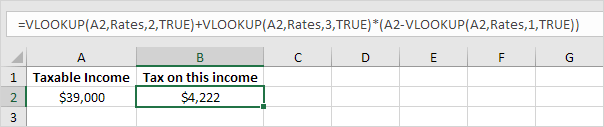

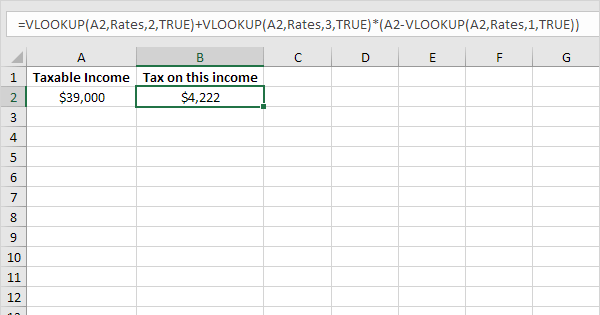

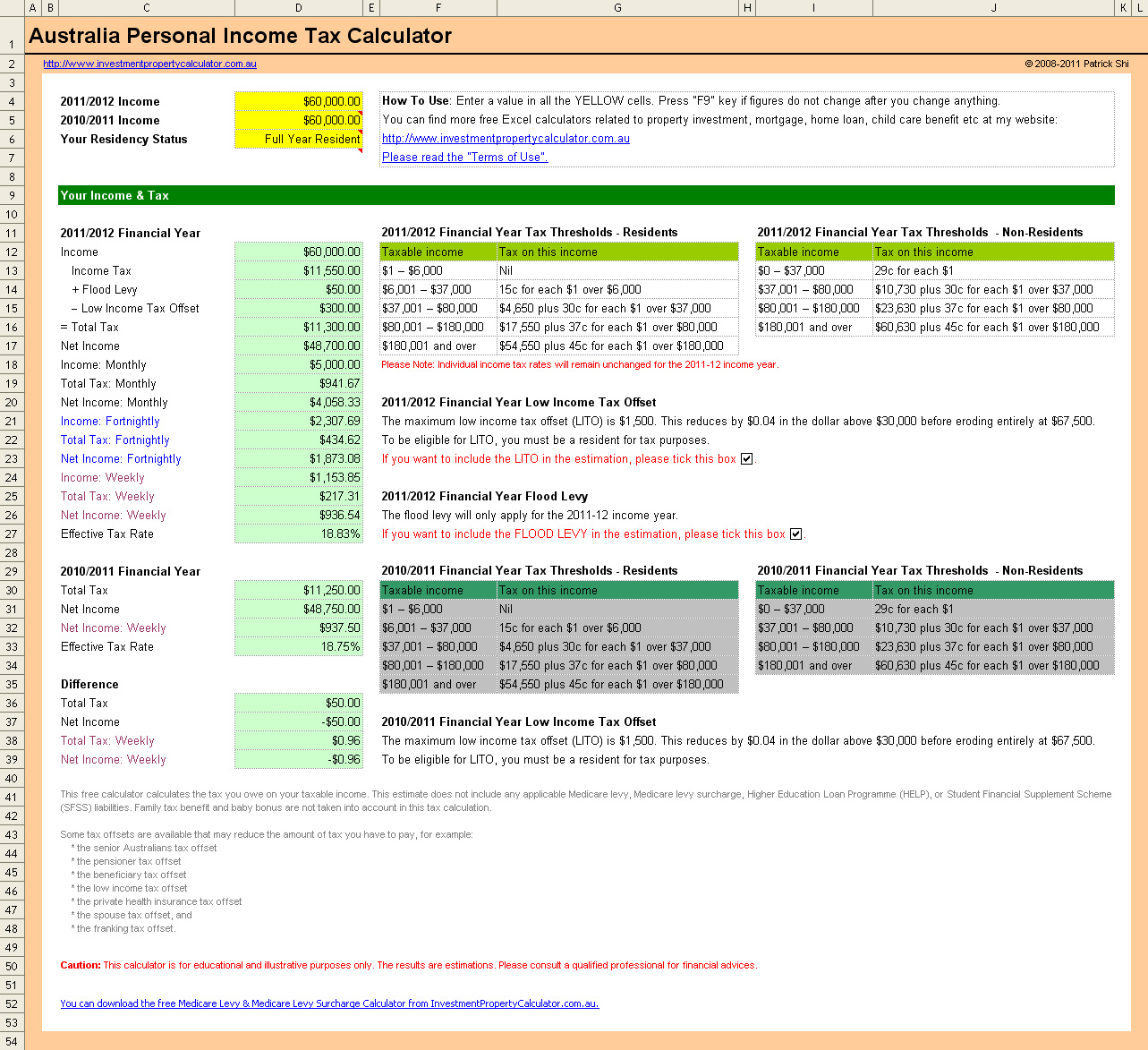

Sydney income tax calculator. Taxable income required other income. You can use this online calculator to give you an estimate of the tax you owe on your taxable income. The tax calculator will also calculate what your employers superannuation contribution will be.

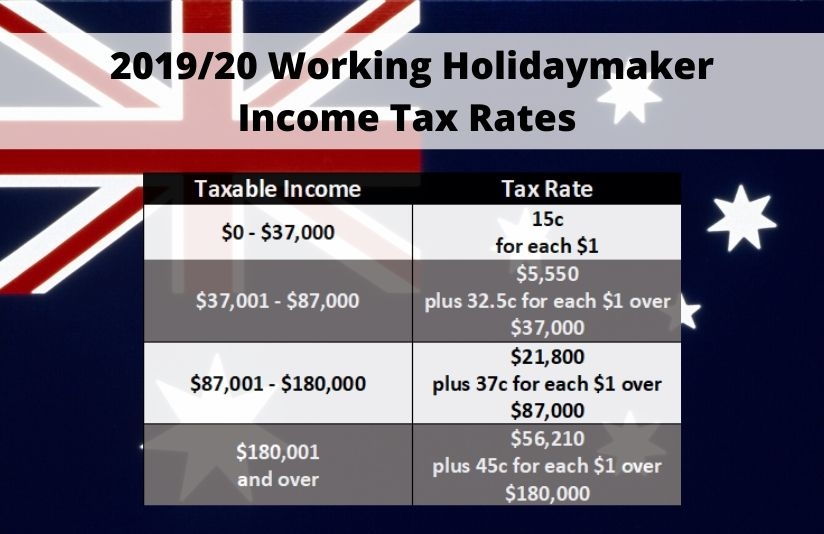

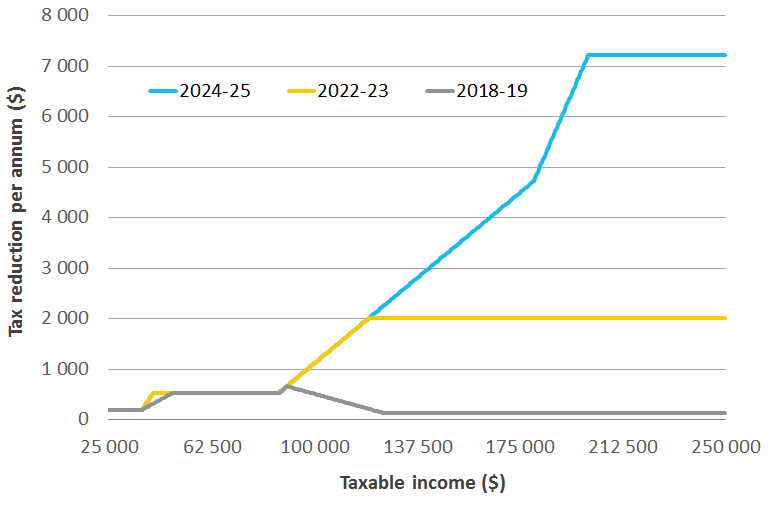

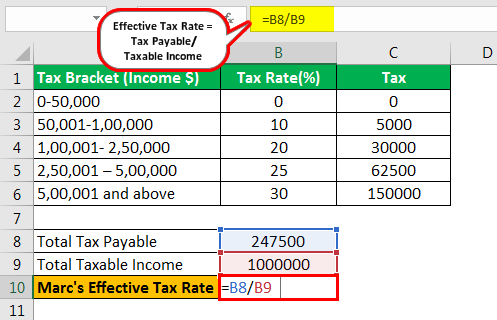

The exact amount of your tax payable or refund can only be calculated upon lodgment of your income tax return. This calculator helps you to calculate the tax you owe on your taxable income. The individual income tax rates will depend on the income year you select and your residency status for income tax purposes during that income year.

Tax and salary calculator for the 2019 2020 financial year. It will also provide you with an estimate of payg employer superannuation contributions. Welcome to taxcalc the australian income tax calculator.

This calculator does not include the new low to middle income tax offset. Mobile banking app check your accounts on the go. Payments apple pay google pay samsung pay bpay paywave direct debitcredit.

The tax return calculator applies current income tax rates set by the australian tax office and factors in important government levies and charges. Internet banking check your accounts and transact online 247. Help repayment thresholds now updated for 20192020.

It can be used for the 201314 to 201920 income years. How the tax calculator works. Npp and payid a faster simpler smarter way to pay.

Calculate home payments interest payments our use our stamp duty calculator tax calculator and more. The income tax rates will depend on the income year you select up to the 3 previous years and your residency status. Income tax estimator this link opens in a new window it will take between 15 and 25 minutes to use this calculator.

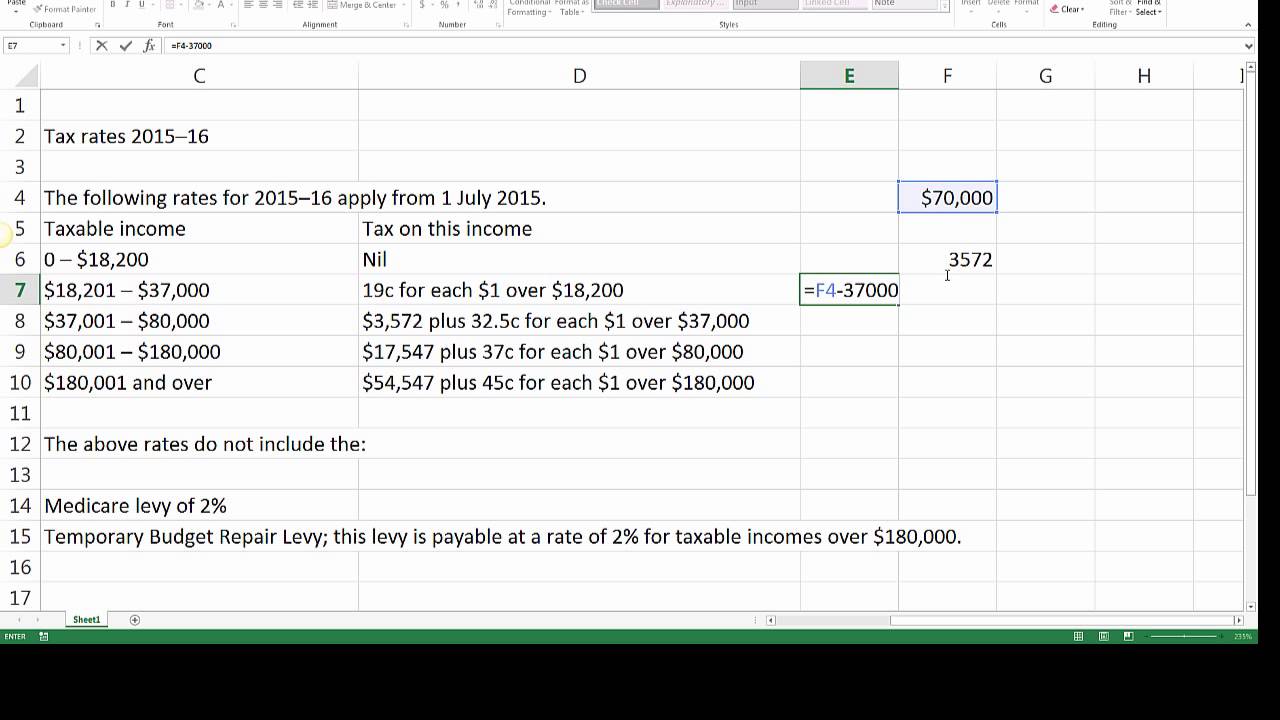

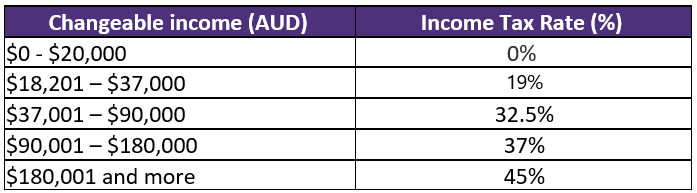

Did you know that the medicare levy increased from 15 to 2 for the 201415 tax year and a budget repair levy of 2 has been introduced on taxable incomes in excess of 180000. Which tax rates apply. Income tax calculator use our calculator to help you plan your home purchase or renovation.

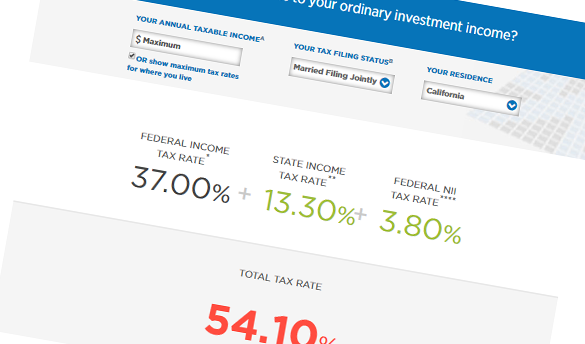

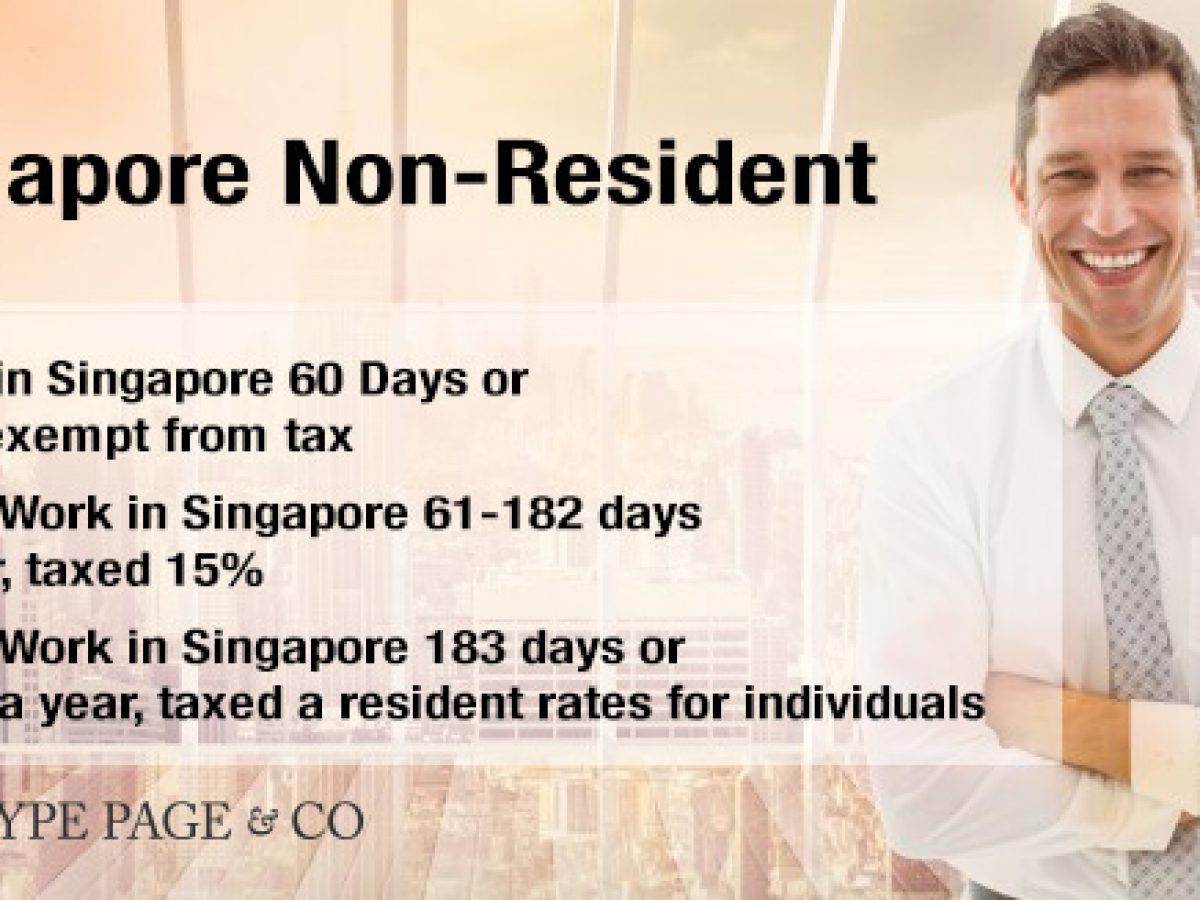

Also calculates your low income tax offset help sapto and medicare levy. Non residents are taxed at a higher rate and are not eligible for the tax free threshold. If youd like a more detailed calculation you can use the income tax estimator.

Use the simple tax calculator if you dont want or need a detailed. Phone banking check your accounts and transact 24 7 via phone. The australian salary calculator includes income tax deductions medicare deductions heps help calculations and age related tax allowances.